Samsung Struggles with a Continued Chip Slump as Investment in AI Calls

- Posted on October 11, 2023

- Technology

- By Arijit Dutta

- 490 Views

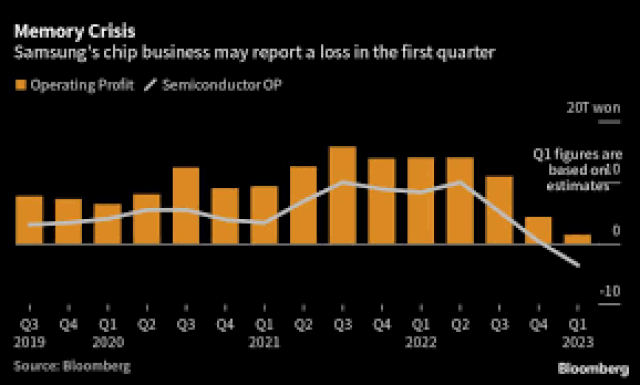

In a persistent tale of economic challenges, Samsung Electronics Co. has revealed its fourth consecutive quarterly sales drop, underscoring the ongoing struggles in the memory chip industry and impacting the world's leading memory chip producer. South Korea's corporate giant reported a notable 13% decrease in sales, totaling 67 trillion won ($50 billion) during the third quarter. This figure, while reflecting market expectations, highlights the gravity of the sector-wide slump that has gripped Samsung.

Image Source -www.finance.yahoo.com

Image Source -www.finance.yahoo.com

In a persistent tale of economic challenges, Samsung

Electronics Co. has revealed its fourth consecutive quarterly sales drop,

underscoring the ongoing struggles in the memory chip industry and impacting

the world's leading memory chip producer. South Korea's corporate giant

reported a notable 13% decrease in sales, totaling 67 trillion won ($50

billion) during the third quarter. This figure, while reflecting market

expectations, highlights the gravity of the sector-wide slump that has gripped

Samsung.

The operating profit of 2.4 trillion won mirrors

estimations of a substantial 78% plunge. Samsung, alongside its industry counterparts,

including SK Hynix Inc. and Micron Technology Inc., grapples with an industry

downturn. Manufacturers of personal computers and smartphones, core clients of

the memory chip industry, have trimmed their orders due to sluggish demand for

tech gadgets and an oversupply of chips.

Recently, the United States granted Samsung and Hynix an

exemption, allowing them to procure necessary equipment for their Chinese

chipmaking operations, reducing uncertainty in their expansion plans. CLSA

Securities Korea analyst Sanjeev Rana emphasized that the waiver assures the

seamless production and operations of Korean memory suppliers in China,

enabling long-term investments and improved competitiveness.

Samsung now strategically positions itself to capitalize

on the impending AI-related technological surge, ignited by the widespread

enthusiasm generated by OpenAI's ChatGPT debut last year. The South Korean tech

giants find themselves in a race to develop AI training tools, where Samsung

aims to catch up with Hynix, the exclusive provider of next-gen DRAM for AI

chipmaker Nvidia Corp. Samsung's ambitious goal is to double its high-bandwidth

memory production capacity by 2024, crucial for accelerating AI training.

Until AI demand picks up, Samsung and Hynix plan to manage economic uncertainties by cutting NAND chip production for PCs and phones, stabilizing DRAM and NAND prices, and indicating potential market stabilization.

Also Read: Indian IT Industry Prepares For Generative AI, Investors Display Cautious Optimism

While awaiting a more comprehensive earnings report later

in the month, Samsung maintains its expectations of a sales rebound in the

second half of the year. The company also strives to compete in the foundry

business, where it currently trails Taiwan Semiconductor Manufacturing Co.

TSMC's quarterly sales saw a lesser decline than anticipated, thanks to growing

demand from AI industry players.

Industry investors eagerly anticipate the translation of

AI chip orders into revenue. However, this outlook is clouded by escalating

inflation and geopolitical turbulence. Samsung, once a beacon in the memory

sector, expanded its capacity to meet pandemic-induced demand, but this move

resulted in significant inventories for the company and its major customers.

The struggle continues for Samsung in the tumultuous

world of memory chips as it simultaneously positions itself to seize

opportunities in the forthcoming AI revolution.