Middle East Tensions Roil US Stocks, Propel Oil Prices; Uncertainty Looms Over Markets

- Posted on October 9, 2023

- International Affairs

- By Arijit Dutta

- 454 Views

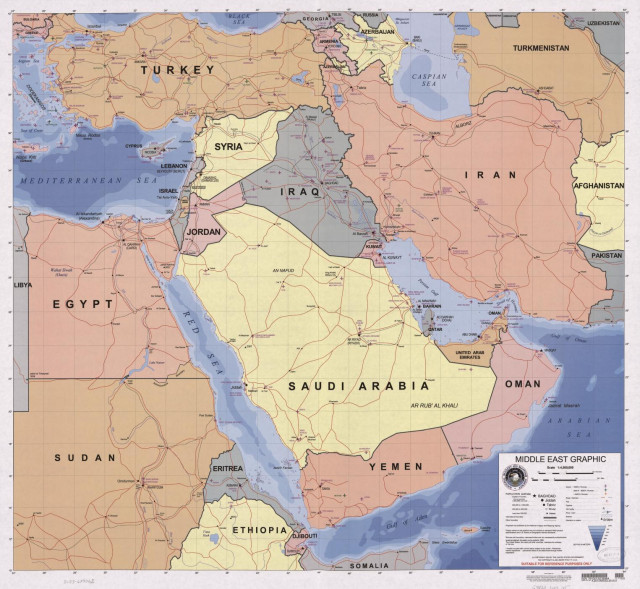

US stock markets faced a turbulent start to the week as escalating military conflicts in the Middle East sent shockwaves through global financial markets. Oil prices surged, while investors sought refuge in bonds and safe-haven assets, driving up Treasury yields. The uncertainty surrounding the situation in the Middle East added to concerns about rising inflation.

Source: https://www.loc.gov/item

US stock markets faced a turbulent start to the week as

escalating military conflicts in the Middle East sent shockwaves through global

financial markets. Oil prices surged, while investors sought refuge in bonds

and safe-haven assets, driving up Treasury yields. The uncertainty surrounding

the situation in the Middle East added to concerns about rising inflation.

US stock futures dipped in Asia on Monday, influenced by

the ongoing military conflict in the Middle East. This geopolitical instability

bolstered oil prices and Treasury yields, creating a sense of unease in the

financial markets. Additionally, the release of the robust September US jobs

report raised expectations for higher inflation figures later in the week.

While Japan observed a holiday, trading conditions

remained thin, with an initial preference for bonds, Japanese yen, and gold,

whereas the euro faced losses.

Analysts at CBA noted, "The risk is higher oil

prices, a slump in equities, and a surge in volatility that supports the dollar

and yen and undermines 'risk' currencies." They emphasized the possibility

of disruptions in oil supplies from Iran, which could further exacerbate the

situation.

In response to the Middle East tensions, Brent crude oil

prices jumped by $2.88 to reach $87.46 per barrel, while US crude climbed by

$3.02 to $85.81 per barrel. Gold also witnessed increased demand, surging by

0.8% to $1,848 per ounce.

The yen emerged as the primary gainer in currency

markets, though the overall movements were relatively modest. The euro dipped

0.3% to 157.44 yen, while the dollar experienced a slight 0.1% decline to

149.14 yen. The euro also eased 0.2% against the dollar, reaching $1.0566.

The cautious sentiment favored sovereign bonds after a

recent period of heavy selling. Ten-year Treasury futures saw a significant

rise of 14 ticks, with yields indicating approximately 4.73%, compared to 4.81%

on the preceding Friday.

Concerns mounted over the impact of sustained oil price

rallies on consumers and inflationary pressures, which weighed on equities.

S&P 500 futures lost 0.7%, while Nasdaq futures shed 0.6%.

As markets contemplated the situation in the Middle East,

expectations for higher interest rates persisted, with the upcoming release of

September consumer price data presenting another pivotal moment. Median

forecasts indicated a 0.3% gain in both headline and core inflation measures,

potentially slowing the annual pace of inflation.

Investors eagerly awaited the release of minutes from the

last Federal Reserve meeting to gauge the seriousness of members' intentions

regarding interest rates. The news from the Middle East appeared to suggest a

possible shift towards a more dovish stance by the Fed, potentially leading to

policy easing in the coming year.

Market sentiment implied an 86% chance of rates remaining unchanged in November, with approximately 75 basis points of cuts priced in for 2024. Meanwhile, China's return from a holiday break promised a flurry of economic data releases, further influencing global markets.

Also Read: University Of Toronto Reassures International Students Amid India-Canada Diplomatic Standoff

The Middle East tensions also cast a shadow over the beginning of the corporate earnings season, with 12 S&P 500 companies, including JP Morgan, Citi, and Wells Fargo, reporting results. Goldman Sachs anticipated 2% sales growth, with a marginal contraction in margins to 11.2% and flat earnings per share compared to the previous year.

Goldman analysts explained, "Near-trend economic

growth and moderating inflation pressures will support modest sales growth and

slim margin improvement." However, they expressed skepticism about

substantial margin expansion due to the prevailing "higher for

longer" interest rate environment, wage growth, and investments in

artificial intelligence by certain tech firms.