SBI Extends Helping Hand to Paytm After RBI Ban, Ensures Support for Users

- Posted on February 4, 2024

- Business

- By Arijit Dutta

- 496 Views

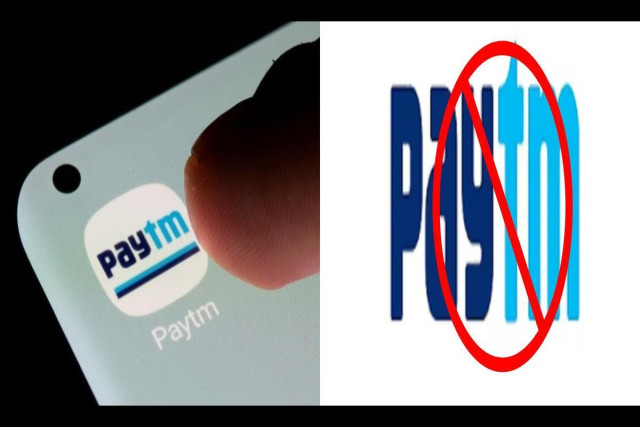

State Bank of India (SBI) offers support to Paytm users post the RBI ban, assuring assistance in line with regulatory directives. SBI Chairman Dinesh Kumar Khara emphasizes readiness to aid millions of Paytm merchants.

Image Source -www.sarkariexam.com

Image Source -www.sarkariexam.com

In

a proactive move, the State

Bank of India (SBI) has stepped in to assist Paytm users affected by the

Reserve Bank of India's (RBI) ban on the fintech giant's operations starting

March 1. SBI Chairman Dinesh Kumar Khara affirmed the bank's commitment to

intervene as per RBI guidance. During the third-quarter earnings briefing,

Khara addressed the media, stating, "If there is a direction from the RBI

to any effect, we will rescue the once-storied Paytm."

The RBI's directive, issued on January 31, compelled Paytm Payments Bank to cease accepting deposits or top-ups in customer accounts, wallets, Fastags, and other instruments after February 29. This effectively halted all primary activities. The regulator, however, assured that any interest, cashback, or refunds owed to customers might be credited back at any time.

Also Read: Indore's Close Call: Hand Grenade Found In Field Safely Defused By Bomb Squad

Khara

clarified SBI's relationship with the fintech firm, stating it was confined to

settlement matters. When queried about the bank's willingness to aid Paytm's

merchant base, consisting of millions of users, Khara responded affirmatively,

stating, "Absolutely." He highlighted that SBI Payments, a

subsidiary, was already in contact with these merchants, ready to offer

point-of-sale (PoS) machines and address their payment needs.

Responding

to whether the bank would support Paytm merchants with their accounts, Khara

expressed a positive stance, saying, "Of course, we can take them on board

in all possible manner." The Chairman emphasized a focused approach and

preparedness to assist Paytm's vast user base, ensuring they seamlessly

transition through the challenging period. This development falls under the

business and finance category, illustrating collaborative efforts amid

regulatory challenges in the fintech sector.