Xi Jinping's Bold Moves: Debt Issuance and Central Bank Visit Bolster Chinese Economy

- Posted on October 25, 2023

- Business

- By Arijit Dutta

- 496 Views

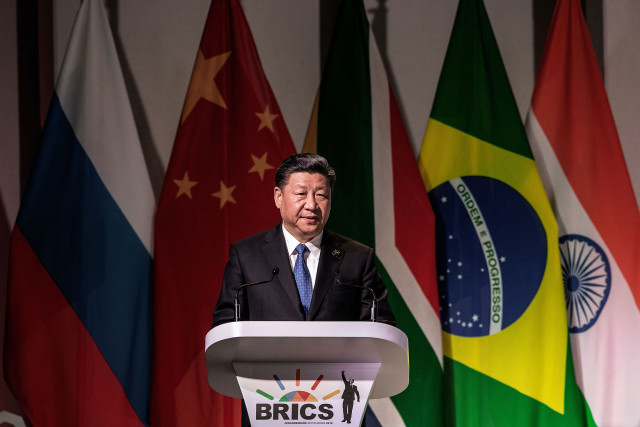

In a remarkable move to bolster the Chinese economy, Chinese President Xi Jinping has taken substantial measures, including the issuance of additional sovereign debt and an unprecedented visit to the central bank, the People's Bank of China (PBOC). These actions reflect China's commitment to shoring up its financial stability and economic growth.

Image Source -www.bloomberg.com

Image Source -www.bloomberg.com

In a remarkable move to

bolster the Chinese economy, Chinese President Xi Jinping has taken substantial

measures, including the issuance of additional sovereign debt and an

unprecedented visit to the central bank, the People's Bank of China (PBOC).

These actions reflect China's commitment to shoring up its financial stability

and economic growth.

The nation's legislature

has given its approval to a plan that significantly increases the fiscal

deficit ratio for 2023, raising it to approximately 3.8% of the gross domestic product

(GDP). This is notably higher than the 3% limit set in March, which was

traditionally regarded as the government's threshold. The plan also encompasses

the issuance of an additional 1 trillion yuan ($137 billion) in sovereign debt

during the fourth quarter, primarily directed toward supporting disaster relief

and construction efforts.

Such a mid-year

adjustment to the budget is rare for China, with past instances occurring

during critical periods like the aftermath of the Sichuan earthquake in 2008 and

the Asian financial crisis in the late 1990s. Experts believe that this

additional fiscal support was necessary to prevent a sudden fiscal tightening

in the closing months of the year.

These budget changes

were part of a series of announcements from the Standing Committee of the

National People's Congress, emphasizing the government's heightened concern

about the economic outlook in the coming year. The unprecedented visit by

President Xi to the central bank further underscores the administration's commitment

to financial stability and economic growth.

This move to raise the

fiscal deficit and issue more sovereign debt is intended to help China achieve

its official government growth target of approximately 5% for 2023. While

stronger-than-expected data for the third quarter has increased confidence in

reaching this goal, several challenges, including ongoing property market

turmoil and deflationary pressures, are expected to persist into 2024.

Additionally, a

significant portion of the special bond issuance will be allocated to fund

post-disaster reconstruction, effectively providing a fiscal stimulus of around

0.8% of GDP. This stimulus aims to support China's recovery in 2024,

particularly against headwinds from declining property construction and exports.

In a noteworthy policy shift, the Chinese government plans to finance infrastructure investment through sovereign bond issuance, shifting more of the fiscal burden to the central government. These funds will be transferred to local authorities for use in various projects.

Also Read:

To further support local

governments facing fiscal challenges, Beijing has initiated a program that

allows struggling regional authorities to exchange high-interest

off-balance-sheet borrowing for lower-interest bonds. The private sector is

also receiving attention, with measures being taken to eliminate barriers and

promote fair competition between private and state-owned enterprises.

In a bid to fortify the

private sector, Xi has reiterated support for private entrepreneurs and called for

their closer alignment with the Communist Party. The People's Bank of China has

pledged to make policy adjustments more targeted and forceful while keeping an

eye on the economy's long-term prospects, indicating that further easing

measures may be in the pipeline.